Florida Real Estate Blog of Aqualand Real Estate located in Florida’s First Coast and serving St Johns and Duval Counties including houses, condominiums, land, and commercial property in Saint Augustine and Jacksonville and across Florida. St Augustine Houses and property for sale.

Blog Posts may be original content or reposted content of other authors, contributors, and/or publications. Copyright remains the property of the creator. Please contact us for usage permission.

Most Recent Florida Real Estate Blog Posts:

-

Jacksonville Home For Sale-Fairways Forest

If You Like to Entertain, This Is The House You Need with Lots of Large Gathering/Entertaining areas both inside and out. 4-beds, 2.5-baths, pool, 0.37-ac with fenced yard.

-

So You Earned Your Florida Real Estate License

You passed your exam and earned your real estate license. Here’s what to do next.

-

State of the Real Estate Market November 2022

Second Half of the 18.6-Year Real Estate Cycle Continues We know it’s hard to fathom that real estate isn’t crashing before your eyes with interest rates rising, home prices dropping a bit, and all the television pundits screaming that the sky is falling. Bad news attracts eyeballs and eyeballs attractRead More…

-

Hurricane Windows and Doors Tax Holiday

No Retail Sales Tax on Impact Windows, Doors, and Garage Doors Through June 2024 If you are purchasing impact-resistant windows, doors, or garage doors, retails sales are EXEMPT from sales tax until exempt from sales tax until June 30, 2024. #ImpactWindows #SalesTaxHoliday #FloridaRealEstate Here is the text of the FAQRead More…

-

Florida Rent Keeps Rising

Florida rents keep rising with 10 of the top 20 highest rent rate increases across the USA being in Florida. Jacksonville is 15th with over a 13% rent increase.

-

4 Tips to Prepare to Sell Your House

4 Tips to Prepare to Sell Your House – simple things you can do to increase curb appeal and increase offers

Last 20 Complete Florida Real Estate Blog Posts:

(Newest to Oldest)

-

Jacksonville Home For Sale-Fairways Forest

SOLD!

3222 Hermitage Rd E, Jacksonville, FL 32277

4-Bed, 2.5-Bath, 2-Car, Pool, 2,098sq ft, 0.37-Acre

Priced As-Is at Just $400,000Seller offering up to 1% toward Mortgage Rate Buy-Down/Prepaids/Closing Costs.

Mortgage Incentive:

Charles King at Grass Roots Mortgage Offering Par Interest Rate with Just 1.5% Total Mortgage Fees

(Most Lenders Currently Charging More Than 2%) Call Charles at 954-296-0098Link to MLS Listing:

https://www.flexmls.com/share/A7Dvt/3222-HERMITAGE-Road-E-Jacksonville-FL-32277

Front View of 3222 Hermitage Rd E If You Like to Entertain, This Is The House You Need

Jacksonville Home For Sale located in the sought after Fairways Forest neighborhood, this lovely home boasts large entertaining areas everywhere it matters. The kitchen/dining area has been opened up to allow large groups to gather in and around the renovated kitchen. Presently set up with a gathering table between the kitchen and large sitting/gathering area, which flows directly into the billiards area with a wood-burning fireplace. This continues to a breakfast nook with sliding doors that exit to the private garden courtyard with flower beds, and opportunities to garden or enjoy a beverage in a serene area away from the main backyard.

The backyard is fully fenced and boasts a large patio, a spacious pool deck surrounding the pool, and a raised deck entertaining area with pergola, hot tub, and space for a bar. The backyard also features a children’s play area, a fire pit, raised garden beds, and many fruit trees. The yard is encircled by mature trees that provide shade and privacy.

The home has been rented periodically via AirBnB, VRBO, and directly both as the complete house and also individual rooms. Most recently, the house was rented for Thanksgiving week at $280/night (plus $120 cleaning fee) and for the Florida-Georgia Game at $800 per night. So, whether you’re looking for the perfect locale for entertaining or for the opportunity for supplemental income, 3222 Hermitage offers the best of both worlds.

Fairways Forest is located inside the Jacksonville 295-Beltline just off Merrill Road near the up-and-coming Arlington area. The house is about 20 minutes from Riverside, San Marco, or Downtown Jacksonville, and less than 30 minutes to JAX Airport or the sands of Atlantic Beach.

The spacious 0.37-Acre Lot is one of the highest points in this quiet neighborhood. The house sits deep in the neighborhood, so there is little to no traffic except your neighbors. The neighborhood has a Voluntary HOA at $125 per year, but again, membership is voluntary.

SPECIAL FINANCING OPPORTUNITY

Charles King at Grassroots Mortgage is offering the Buyer of this home the Par Interest Rate with REDUCED LOAN FEES of just 1.5% with a mortgage application prior to 2/29/24. Buyers can get prequalified with Grassroots Mortgage regardless of whether this particular home is purchased or not. Please mention Aqualand Real Estate when you call to receive the special reduced fee rate promotion. Aqualand does NOT receive compensation for this promotion.

Get Prequalified for Any Florida Mortgage with

Charles King at Grassroots Mortgage 954-296-0098

Overlooking the Pool to the Hot Tub, Pergola, Fire Pit, Raised Beds in the Fenced Back Yard For More Information and Personal Showings,

Please Contact Branon Edwards at 786-417-49104-Bedroom, 2.5-Bath

2,098 Square Feet Under Air (2,616 Total Square Footage)

Spacious 0.37-Acre Lot with Higher Elevation

Built 1976

Concrete Block with Stucco Exterior

Circular Driveway with Garage

Pool with Removeable Child Fence and Roll-Away Cover

Hot Tub with Raised Deck and Pergola with Room for Bar

Raised Beds

Fenced Yard

New Tile in Living Areas

Primary Bathroom Upgraded

Updated Kitchen

Plenty of Fruit Trees Including Lemon, Lime, Peach, Pomegranate, Small Mango, Banana, Loquat, and 4 Types of Bamboo (Black, Florida, Japanese, and Thai)Lots of recent upgrades include new flooring, granite counters, cabinetry, and fresh interior paint. The driveway, pool deck, and patio were all recently powerwashed. There are still some minor projects where you can add your personal touch. Please note that this house, like many in Duval County, has aluminum wiring that has been mitigated with Alumicons.

Large Gathering/Entertaining Area Around the Renovated Kitchen

Renovated Kitchen with Stainless Appliances, Granite Counters, New Tile, and Cabinetry

Looking from the Sitting Area to the Renovated Kitchen

The Living Room Exits to the Pool Entertaining Area

Fresh Tile in the Living Room that Exits to the Pool Patio

Living Room to Double-Entry Doors

Enjoy a Tasty Beverage in Serenity in Your Private Garden Courtyard

Looking from Courtyard to Fenced Backyard

Outdoor Entertaining Area Around the Pool with Hot Tub, Pergola, and Raised Deck

Overlooking the Pool to the Hot Tub, Pergola, and Fire Pit in the Fenced Backyard

Overlooking the Pool to the Hot Tub, Pergola, Fire Pit, Raised Beds in the Fenced Back Yard

Looking from Courtyard to Fenced Backyard

Large Fenced Back Yard with Fire Pit, Raised Garden Beds, and Mature Trees

Primary Bedroom with Large Vanity and Walk-In Closet

Primary Bedroom with Large Vanity and En Suite Walk-In Shower

Primary Bedroom Looking from Bed to the Bathroom, Vanity Area, and Closet

Primary Bedroom En Suite Bathroom with Vanity and Walk-In Shower

Nicely Appointed Guest Room, Frequently Rented as Separate AirBnB

Guest Bedroom with Mounted TV

Guest Bedroom Currently Set Up as Children’s Room

Guest Bathroom with Vanity and Separate Tub Shower

Guest Bathroom Tub/Shower with Retro Tile

Backyard with Fire Pit and Fruit Trees

Visitors Can Easily Spot Your Mailbox

Large Mature Trees and High & Dry Lot with Circular Driveway For More Information and Personal Showings,

Please Contact Branon Edwards at 786-417-4910You Can Also Contact Us Here

SPECIAL FINANCING OPPORTUNITY

Charles King at Grassroots Mortgage is offering the Buyer of this home the Par Interest Rate plus REDUCED LOAN FEES of just 1.5% with an application prior to Feb 29, 2024. Buyers can get prequalified with Grassroots Mortgage regardless of whether this particular home is purchased or not. Please mention Aqualand Real Estate when you call to receive the special reduced fee rate promotion. Aqualand does NOT receive compensation for this promotion.

Get Prequalified for Any Florida Mortgage with

Charles King at Grassroots Mortgage 954-296-0098

-

So You Earned Your Florida Real Estate License

What to Do After You’ve Passed Florida Your License Exam

WooHoo! You passed your exam and have earned your Florida Real Estate License. What happens next? Hopefully, you’ve done some soul-searching and have a really solid ‘Why’ you’ve entered this industry… and hopefully, that Why is more than just potentially earning a good income. You didn’t think this was going to be easy, did you?

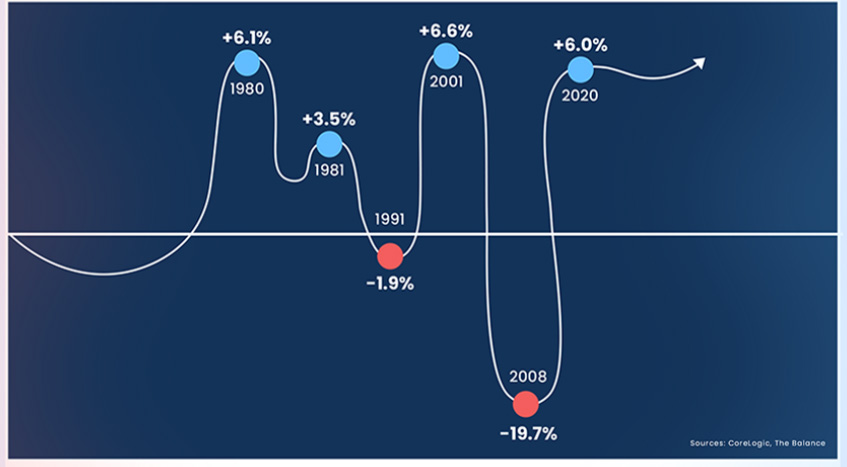

Welcome to the 18.6-Year Real Estate Cycle. As of this writing (April, 2023), the United States is well into the Second Half of the 18.6-Year Real Estate Cycle. What does that mean? Well, you’ll need to read ‘The Secret Life of Banking and Real Estate’ or become a student of Philip J. Anderson and Akhil Patel at Property Sharemarket Economics to gain a better understanding of the concepts and timing involved.

You can also refer to our previous posts here:

https://StAugHouses.com/staughouses/18-6-year-real-estate-cycle https://StAugHouses.com/staughouses/housing-bubble-not-yet

During the second half of the Real Estate Cycle, the value of real estate increases at a fever pitch. Buyers toss caution (and Location-Location-Location) to the wind, and buy with both fists. Investors and Developers leverage themselves to the hilt and build with wild abandon in a mad rush to the top… and then to the bottom. Government does its best to be inclusive and creates all sorts of incentives (and funding mechanisms) for under-represented populations to enter the real estate market without regard to their ability to repay in the future.

Regretfully, many of these folks will not have been given the tools to avoid foreclosure when the market shifts. In addition, since they’ll be some of the most leveraged via low down payment FHA loans, down payment assistance in the form of credits, loans, or grants, extended debt-to-income ratios, additional qualification support with Adjustable Rate Mortgages (ARMs), or even 100% financing similar to the offerings during the last cycle that topped in 2007/2008.

This buying frenzy entices thousands upon thousands of average folks to pursue a real estate license. Being a Real Estate Agent seems easy enough: you show a few houses or make a few listing presentations, you put a house under contract, and you collect a tidy commission…. right? That is an amazingly and overly naïve simplification, but that, alone, entices hoards of new agents into getting their licenses every single cycle.

While some of these second-half agents will figure out how to save money in the good times so they can survive the lean times, a great many simply do not understand the cyclical nature of real estate and find themselves seeking other career opportunities after the inevitable top and subsequent 4-year real estate correction (see 2007/2008 to 2011/2012). Let’s see if we can help you through this part of the cycle and prepare you for what’s next.

So, You Passed Your Florida Real Estate Exam

Congrats! If this is your first foray into real estate, hang your license with a major franchise real estate brokerage and take EVERY course they offer as quickly as you can.

Forget ‘brokerage split’ and franchise fees for the moment. Focus on education and working your ‘sphere of influence’ for Buyer and Seller opportunities so you don’t starve to death in the first 6-8 months. You should have entered this process with at least a 6-month nest egg, but you probably didn’t, so let’s move on anyway.

Once you know what you’re doing (the license course and exam do NOT prepare you for the real world of real estate), then you can decide whether you want to incrementally give up support to increase your split.

Keller Williams and Coldwell Banker both have great newbie training programs that will help you for the DURATION of your career. Too many new agents are focused on making the highest percentage split they can right out of the gate… and when the market cools (as it will in or after 2026), they have no idea how to weather the storm of a 4-year downturn. Having the initial support of a major name will also help you overcome the objection of your being new in the business. After all, you have bevvy of folks who all have a vested in your personal success.

This is NOT to say that small, independent offices should be avoided, just that you will need support and education to build your skillset for long-term success. If a small office broker is willing to mentor you and basically provide on-the-job training (OJT), that can work. However, it takes more than just promises; there needs to be sincere follow through.

Find a Mentor

Whether it’s your Broker or an experienced agent in your office, find someone who is willing to mentor you. If you’re not an expert in something, find someone who is, and ask for help. Be respectful of their time and knowledge and show appreciation. Some folks like verbal gratitude, others like meals or gifts, others like cash. Need to pick their brain about a tough deal? Take them to lunch to discuss it.

Find out how THEY prefer to communicate (in person, via email, via text, via phone call, etc) and communicate with them per their preference. If an agent is helping you land a customer or client, offer to cut them in on the deal with a referral fee that is commensurate with the help they’re giving you. Everyone likes to be appreciated, but getting paid is a professional way to show that, when appropriate. Your broker is likely already benefitting financially for your success, so you shouldn’t necessarily have to compensate them monetarily, but think about how you would like to be treated, and act accordingly.

By the way, it’s okay to take and keep notes about people’s preferences like how they take their coffee, favorite flowers, hobbies, favorite restaurant, and so on. This is true for colleagues, mentors, and customers. If you give thoughtful gifts when you show appreciation, it confirms you’re paying attention and actually care.

Study and Understand the 18.6-Year Real Estate Cycle

Educate yourself on the 18.6-year real estate cycle (which nobody in real estate teaches). Read ‘The Secret Life of Banking and Real Estate’ and follow Property Sharemarket Economics (I get no kickback). It will help you provide fiduciary services to your customers and clients that will keep them coming back and referring their friends/family.

Document, Save, and Invest

Open a Roth IRA ASAP. Always pay yourself first. Save 50% of your income so you can cover your taxes and put money away for the inevitable commission droughts. Build a fund to cover at least 6 months of personal expenses and don’t touch it… then expand it to 12 months, and again, don’t touch it.

Put at least 10% into investments (Roth, real estate tax certificates, index funds, etc). Hire a great CPA. Find an experienced attorney. Find 3 honest local home inspectors and at least 2 local honest handymen. Track ALL of your expenses in a spreadsheet, and use cash-back credit cards for EVERYTHING. Regularly use the cash back to pay down balances.

Forget about vacations for awhile; you’re building a business and spending/wasting valuable capital on a cruise or a trip should not be your first priority. Work/life balance is likely going to be a struggle. As Realtors, we often work when everybody else is off. Expect your phone to ring at all hours of the day and night and expect to work weekends and most holidays. There are gurus out there who teach you to run your business like a workweek 9 to 5. That’s a nice idea, but for the moment, you work when there’s work to do. As a mentor once told me, “I will do today what others won’t, so I can live tomorrow as others can’t.”

Document your mileage on EVERY trip by app or calendar entry and document your odometer reading the day you start using your vehicle for real estate and at the last and first day of EVERY calendar year. Keep EVERY receipt – that includes parking, tolls, restaurants, etc… Using a credit card and keeping PDF copies of your monthly credit card and bank statements will make your life easier during tax time. Create a folder on your computer called Receipts and file PDFs in that folder throughout the year. Likewise, create an email folder called Receipts and file those online purchase email confirmations in it – again, get organized now to save time and effort later. You can’t deduct an expense you can’t find.

Protect Yourself and Your Business

Consider creating a Professional Association (PA) or a Limited Liability Company (LLC) for your real estate activities to help minimize liability. Look into, understand, and acquire Errors and Omissions (E&O) Insurance because lawsuits have, unfortunately, turned into the American Retirement Plan.

Do NOT increase your lifestyle to match your increasing income… don’t buy luxury items or sign contracts to pay for crappy leads regardless of sales pitch/reviews. Build the brand that is YOU, and it won’t matter which company with whom you hang your license. (See also social media marketing, personal branding, and e-PRO certification.)

Become a Broker

After 2 years, take the broker course, even if you have ZERO interest in opening your own brokerage. As my Broker Instructor said during our course, “The Broker is always broke.” While being the king/queen of your own castle sounds great (and it can be), it also means your overhead will increase beyond any planning you might do. Being a broker provide more education, more connections, and moves you forward in the expert category.

Take all of your classes IN PERSON so that you can rub elbows with experienced agents and hear real-world examples and stories. Online courses are convenient and meet CE requirements, but you don’t make friends/alliances that will inevitably help your ongoing career. I avoided many mistakes simply because of shared stories in my in-person courses. There are always pitfalls and easily-made mistakes that can be avoided if you know such mistakes are even possible.

Become a Fiduciary

TRULY understand what fiduciary responsibility means and vigilantly practice it EVERY SINGLE DAY. Don’t let water-cooler talk, buddy chat, venting, or braggadocio undermine your customers… EVER.

The agents who make it in this business understand cycles, focus on niches in which they become actual experts, build their brand, and ALWAYS put their customers’/clients’ needs and desires ahead of their own.

Your job is to assist your customer/client in finding the property that is perfect for them at that moment… not to maximize your time or commission. Yes, you need to create boundaries and communicate them, but understand that focusing on YOUR needs will put you out of business in a hurry. Keep your personal commentary to a minimum during showings. You never know which innocent or joking comment is going to trigger a Buyer or Seller into shutting down. Obviously, if you have expert commentary such as the condition of a roof or foundation, you’re expected to point those things out. However, providing your personal opinion on decor or housekeeping is immaterial and can be detrimental. As an example, you might walk into a room with a hot pink accent wall and be aghast. At the same time, the Buyer may be thinking it’s their kid’s favorite color and it’s fantastic. If you poke fun at the color, you likely just alienated your customer, and that could be enough for them to decide to work with someone else.

Expert comments = Yes. Personal opinions = No.Write Down Your Goals

Figure out your income goals for your first year and work backward to figure out how much volume you’ll need to make to satisfy that. Once you have your goal volume, work backward to determine how much volume you’ll need each month. Your broker can help work that backward into figuring out what sort of pipeline of business you’ll need to get there. Back further to how many appointments. Back further to how many leads. Back further into phone calls and/or marketing efforts. Start with a WRITTEN GOAL in mind and work it backward to figure out what you need to do on a monthly, weekly, and even daily basis to reach that goal.

Don’t let ANYONE (even your broker) convince you to reduce your goals or dumb-down your results. My first day in the business, I told my Managing Broker in my initial planning session that I wanted to sell $10mm my first year. She thought that was ‘a bit high’, and that I should be more realistic, so I downgraded it to $5mm. At the end of the year, my partner and I sold $8.5mm, and we sold $12.5mm our second year… in a market where we had NO sphere of influence. There’s no telling what we would have sold if I had stuck to my guns on $10mm. (Btw, she apologized later when we received the Rookie of the Year Award for our office.)

You Are Considered An Expert… Even If You’re Not

Your license designates you as an expert even though you presently are NOT an expert at anything other than taking a course and passing an exam. Your journey is literally just beginning and the only person accountable for your success is YOU. So again, we’re back where we started. Focus on educating yourself, honing your craft, and getting to work. Don’t get paralyzed by the seeming enormity of the task at hand. Focus on breaking down your goals into bite-sized pieces and work on them everyday.

You can do this, but YOU have to do it. Always carry business cards and work the fact that you’re a real estate agent into conversations as casually as you can. Don’t be obnoxious, but do let people know what you do. If you do mention your business, be sure to ask about theirs as well. You never know where your next customer or contractor is going to come from unless you ask.

Good luck and do your best each and every day to become a better expert at helping other people get what they want, and you’ll find what you want takes care of itself.

-

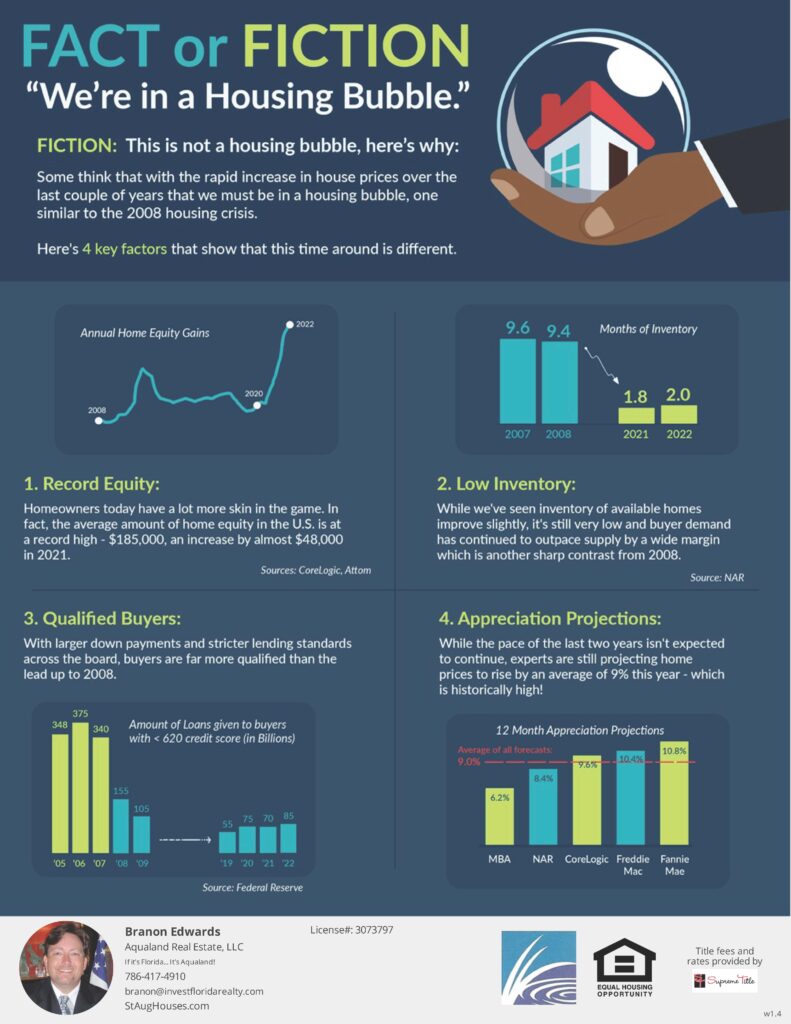

State of the Real Estate Market November 2022

Second Half of the 18.6-Year Real Estate Cycle Continues

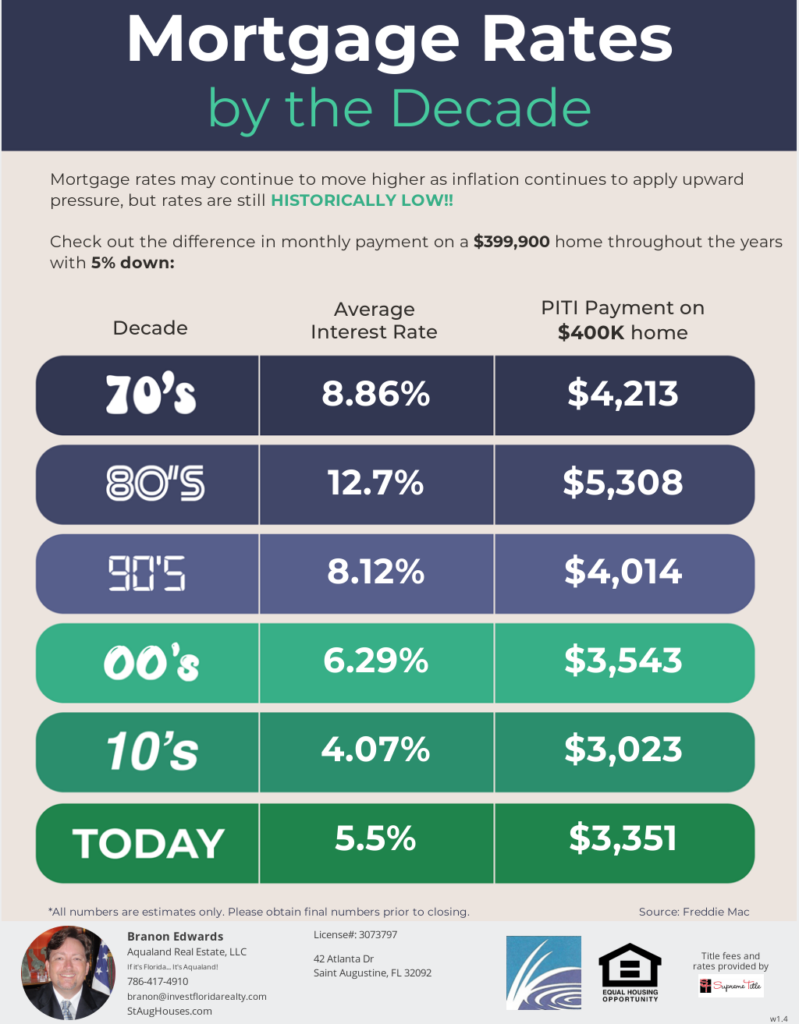

We know it’s hard to fathom that real estate isn’t crashing before your eyes with interest rates rising, home prices dropping a bit, and all the television pundits screaming that the sky is falling. Bad news attracts eyeballs and eyeballs attract advertising. If you keep this in mind, you realize that the media really has no incentive to find silver linings or to accurately report markets.

Red-Shouldered Hawk by the Reserve Lake at Arbor Mill at Mill Creek in Saint Augustine, Florida. (C) Branon Edwards 2022. All Rights Reserved. A hawkish Fed is likely to raise interest rates yet again. Yes, the Fed was/is certainly behind the curve, as per usual. They ignored the trillions in stimulus pumped into the economy and kept printing with wild abandon to get inflation up to 2%. Once inflation caught up, they mistakenly assumed and overstayed their welcome on the “Inflation Is Transitory” narrative. They were too late to raise rates and then overcompensated, again, as per usual. At the same time, they unwound the balance sheet, which deflated the stock market. The combination of falling asset prices, a rising dollar, and increasing inflation has been a triple-whammy that combined with skyrocketing energy and food prices to wreak all kinds of havoc across the economy.

In spite of all that, banks are sitting on mountains of cash and housing inventories are still low. Banks make more money when they lend, so expect that process to flip into high gear shortly, which will help fuel markets again. Increased interest rates have given some home buyers pause, primarily because the increase in interest rates has lowered their potential loan amount.

Add to that the fact that a lot of folks were already living paycheck-to-paycheck and they turned to their credit cards to make up the shortfall. Credit card balances in the USA have increased substantially over the last year, which of course, affects debt-to-income ratios and thus, loan amounts, especially when credit card interest rates are typically variable and have been going up as well.

This sounds like the perfect storm, but it really isn’t. Unlike 2008, home owners are sitting on quite a bit of equity this time around. Many folks aren’t actually tapping their equity like they did last time because of rising interest rates, and again, HELOCs (home equity lines of credit) are generally variable interest rate products, which makes them somewhat less attractive.

One trend that is a bit disconcerting is the resurgence of ARMs (adjustable-rate mortgages). While there are certainly ARM strategies that can make sense, getting a short-time adjusted ARM in a rate-rising environment is typically ill-advised. Personally, we’ve never been a fan of ARMs. Mortgage brokers and bankers will scream that they have their place, but most borrowers simply don’t do the math.

If you have a 3-year ARM, your interest rate is only fixed for the first 36 months. After that, the rate adjusts based on the new interest rate. If there aren’t specific limits on the adjustment, the borrower’s payments could change drastically.

As an example, a $500,000 3-Year ARM at 5% with a 30-year amortization equates to a monthly payment of $2,684.11.

If that interest rate adjusts to 7% at the end of 36 months, the new payment becomes $3,326.51. That’s an increase of $642.40 or a 23.9% payment increase.

If all you can afford right now is $2,684, what’s the likelihood that your income will increase by 23.9% in the next 3 years? For most people, that seems unlikely, but they rarely do the easy math, let alone the worst-case-scenario math.

These types of interest rate adjustments priced a lot of people out of their homes in 2008. Couple that with a softening real estate market, and folks couldn’t sell their houses for what they owed on them. As a result, the short sale and foreclosure industry exploded with distressed houses.

Many of those were snapped up at the bottom in 2011/2012 by well-funded hedge funds and investors who were waiting in the wings. If you’ve been paying attention, hedge funds are not only buying single family homes one at a time, but also, they’re building entire single-family neighborhoods that are being rented out.

Our July report goes into this in a bit more detail, which you can read here:

https://StAugHouses.com/staughouses/real-estate-market-update-july-2022If you absolutely need to get an ARM to buy your next property, at least make it a 5-year or 7-year adjustable. At this time, however, we highly suggest buyers align their house hunting to more closely fit their NEEDS than their WANTS and go with a 30-Year Fixed Mortgage. Even though the interest rates are above 6% right now, you can always refinance later.

With a fixed mortgage, you don’t HAVE to refinance if interest rates continue upward where you might HAVE to refinance if you decide on an adjustable rate. Even if you can afford a 15-Year Fixed Mortgage, we still suggest a 30-Year. This puts the lightest load on you to make your monthly payments.

If you’re having a good year and want to make extra payments – do so, but you’re not REQUIRED to do so. In other words, you can treat your 30-Year Fixed Mortgage like a 15-Year Fixed Mortgage, but you cannot treat a 15-year like a 30-year. Create the smallest possible obligation and discipline yourself to keep to your budget and your pay-off plan when times are good.

So, what’s the market actually look like right now?

Here’s the data for Single-Family Detached Homes in the Saint Augustine MLS for the Current State of the Real Estate Market

As of November 14, 2022:

877 Currently Listed

$651,105 Average List Price

78 Average Days on Market (A typical healthy market is 3-4 months, up to 6 months)

2022 Year-to-Date:

4,637 Total Houses Listed

3,761 Total Houses Sold (86.12%)

$511,178 Average List Price

$503,604 Average Sold Price (98.52% of Ask Price)

35 Average Days on Market

August 1, 2002 to November 14, 2022:

1,098 Listed

961 Sold (87.52%)

$522,830 Average List Price

$507,215 Average Sold Price (97.01% of Ask Price)

37 Average Days on MarketYear-to-date, houses have taken about a month to sell and have sold at a mere 1.48% Discount to Asking Price.

In the last several months, houses have taken about a month to sell and have sold at a 2.99% Discount to Asking Price.

So, what is the real estate data telling us?

It’s telling us that it’s still a Seller’s Market and that inventory is still low.

While there is a little more negotiation happening, we still believe that properties that are priced correctly from the start sell more quickly than those that are over-priced in the ‘hopes’ of squeezing out a bit more. There’s a fine line between overpricing and sitting on the market versus pricing correctly and selling quickly.

Average days on the market of properties that are presently listed have gone up quite a bit (roughly double), but the days it takes to sell is still well below what is typically considered a healthy market.

100% Cash Purchases Still Make Up a Significant Percentage of the Housing Market

Keep in mind that there is a huge chunk of the market that is ignoring interest rates entirely. All-cash purchases still make up about half of the properties sold in Florida. Those folks aren’t worried about what the 10-Year Treasury did today or what interest rates might do next month. Many of those folks also are coming from higher-priced markets and finding Florida houses well within their cash price targets.

Rentals and AirBnB

We’re still seeing investors acquiring real estate to obtain income through rentals, particularly short-term rentals like AirBnB. With the economy in flux and expenses up, some folks are pausing travel plans, so services like AirBnB will remain competitive. As always, Location-Location-Location is the most important aspect of any property purchase.

For short-term rentals, having an off-platform marketing plan outside of clearinghouses like AirBnB and VRBO, is extremely important. Build a clientele and rent direct when possible and prudent – there’s something to be said for assistance when things don’t go as planned. The more unique and user-friendly the rental is will also set you apart from other nearby options.

You can find local short-term rental information on our website here:

https://StAugHouses.com/staughouses/airbnb-and-short-term-rentalsYes, we still stand by our July report:

https://StAugHouses.com/staughouses/real-estate-market-update-july-2022

Review our 18.6-Year Real Estate Cycle post as well here:

https://StAugHouses.com/staughouses/18-6-year-real-estate-cycleWe maintain that we are firmly in the second half of the 18.6-year real estate cycle.

Newest/biggest/best/innovative real estate developments are still being announced and have completion dates in the 2026-time frame, which we believe will be the top of the real estate market for this cycle. That top will likely be followed by a 4-year decline in real estate prices, a rise in foreclosures, and this time, we expect many of the too-big-to-fail banks and financial institutions to actually fail.

We suggest you research your banking institutions to minimize systemic risk since this banking crisis is likely to be met with Bail-Ins instead of Bail-Outs, meaning your cash gets converted to stock in the bank because they simply don’t have the cash available to disburse deposits. See the Cyprus Banking Crisis last time around.

This month’s failure of crypto exchange FTX is an example of the kind of failures that can occur and the magnitude to which they can affect the masses, seemingly from out of the blue. The media was touting the brilliance of the folks running FTX with Fortune Magazine even calling SBF (Sam Bankman-Fried) the ‘Next Warren Buffett’ and others calling FTX ‘The Next Goldman Sachs’. Sadly, for investors, it seems that he was actually the ‘Next Bernie Madoff’ running the ‘Next Bear Stearns’.

Thus far, it looks like $15 Billion (with a B) was liquidated almost overnight. Granted, this is likely the result of a combination of extreme risk-taking and over-leverage coupled with actual malfeasance and fraud, but the 2008 Bank Bailout wasn’t any different. FTX was considered too big to fail as well, but here we are. FDIC Insurance was near collapse in 2008, so don’t think that you’re covered just because you spread your accounts around.

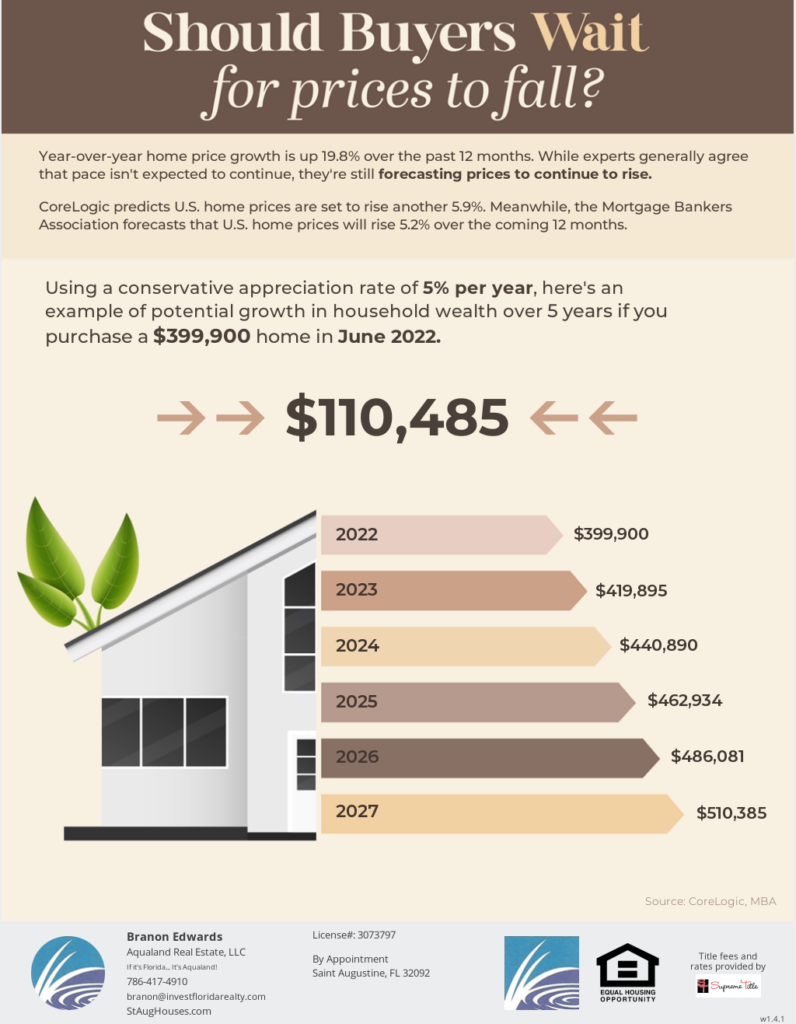

Is it a good time to buy a home?

The short answer is almost always, YES.

Wood Stork by the Reserve Lake at Arbor Mill at Mill Creek in Saint Augustine, FL. (C) Branon Edwards 2022. All Rights Reserved. You have to live somewhere, and you’re either paying your own mortgage or your landlord’s. Regardless of a 2026 top, that’s 4 years of potential asset appreciation you’ll miss if you’re renting. It’s nearly impossible to buy the exact bottom or sell the top, but you can certainly put yourself in a position to catch a good chunk of the move upward.

Our general outlook is not to wait to buy. If you need/want to change residences, buy despite interest rates, and simply refinance later when rates inevitably come back down. In addition, buy what you actually afford. Forget about keeping up with the Joneses or having the biggest house on the block. Just because you qualify for a large mortgage doesn’t mean you should take on that much leverage.

Consider your current and potential future financial positions and buy or invest accordingly. We can assist you in working out budgets, locating rental property opportunities, and of course, we work with one of the best mortgage brokers in Florida to make the prequalification process simple and painless.

Buying or Selling doesn’t need to be a daunting process. Having someone who represents your interests and will walk you through every step along the way is why you choose a Realtor in the first place.

Stress doesn’t need to be a closing cost.

If you’re considering buying or selling in Saint Johns County of Duval County, please consider us. We are an independent real estate brokerage where you are treated like family, not as a faceless number in a sea of franchises.

Thank you for the opportunity to earn your business.

-

Hurricane Windows and Doors Tax Holiday

No Retail Sales Tax on Impact Windows, Doors, and Garage Doors Through June 2024

If you are purchasing impact-resistant windows, doors, or garage doors, retails sales are EXEMPT from sales tax until exempt from sales tax until June 30, 2024. #ImpactWindows #SalesTaxHoliday #FloridaRealEstate

Here is the text of the FAQ from the Florida Department of Revenue (Images of PDF Above):

Florida Impact-Resistant Windows and Doors

Sales Tax Exemption Period:

Frequently Asked Questions for Consumers1. What happens during the Florida Impact-Resistant Windows and Doors Sales Tax Exemption Period?

During the Florida Impact-Resistant Windows and Doors Sales Tax Exemption Period, you may purchase impact-resistant windows, doors, and garage doors exempt from sales tax on retail sales. “Impact-resistant windows,” “impact-resistant doors,” and “impact-resistant garage doors” refer to windows, doors, and garage doors that are labeled as impact-resistant and have an impact-resistant rating.

The two-year tax exemption period begins on Friday, July 1, 2022, and ends on Tuesday, June 30, 2024. Additional information on exemptions during the tax exemption period is provided in Tax Information Publication (TIP) No. 22A01-07. (Included Below)

2. Is there a limit on the number of impact-resistant windows, doors, and garage doors that can be purchased tax-exempt during the sales tax exemption period?No, there is no limit on the number of impact-resistant windows, doors, and garage doors that can be purchased tax-exempt.

3. Do impact-resistant windows, doors, and garage doors need to be under a certain price to qualify for the sales tax exemption?No, there is no price limit for impact-resistant windows, doors, and garage doors to qualify for the sales tax exemption.

4. Will I have to pay sales tax if I purchase qualifying items during the Florida Impact-Resistant Windows and Doors Sales Tax Exemption Period using a gift card?No. When qualifying items are purchased during the exemption period using a gift card, the qualifying items are tax-exempt; it does not matter when the gift card was purchased.

5. Does the Impact-Resistant Windows and Doors Sales Tax Exemption Period also apply to items I purchase online?Yes. Impact-resistant windows, doors, and garage doors purchased by mail order, catalog, or online are exempt when the order is accepted by the company during the sales tax exemption period for immediate shipment, even if delivery is made after the sales tax exemption period. Fla. Dept. of Revenue, Florida Impact-Resistant Windows, and Doors Sales Tax Exemption FAQs Page 2

6. If I buy a package or set of items that contains both tax-exempt and taxable items during the Florida Impact-Resistant Windows and Doors Tax Exemption Period, how is sales tax calculated?If a tax-exempt item is sold in a set with a taxable item, sales tax must be calculated on the sales price of the package or set.

7. If I receive a rain check for a qualifying item during the Impact-Resistant Windows and Doors Sales Tax Exemption Period, can it be used after the exemption period to purchase the item tax-exempt?No. The purchase of the qualifying item must be made during the exemption period to be tax-exempt. When a rain check is issued, a sale has not occurred. The sale occurs when the rain check is redeemed, and the item is purchased.

8. Does the Florida Impact-Resistant Windows and Doors Tax Exemption Period also apply to items I purchase online?Yes. Qualifying impact-resistant windows and doors purchase online are exempt when the order is accepted by the company during the sales tax exemption period for immediate shipment, even if delivery is made after the tax exemption period.

9. Who is responsible for determining which items are exempt and which aren’t?The Impact-Resistant Windows and Doors Sales Tax Exemption Period is established through the lawmaking authority of the Florida Legislature. Sales tax exemption periods, and the items exempted by the exemption period, must be passed into law by the Legislature.

10. How can I request that a certain type of product be added to the list?Sales tax exemption periods, and the items exempted by them, are passed into law by the Florida Legislature. You may wish to contact your local representative regarding your suggestion.

11. I didn’t see my question listed here. Where can I find additional information about the Florida Impact-Resistant Windows and Doors Sales Tax Exemption Period?If you have a question about this sales tax exemption period that is not addressed in TIP No. 22A01-07 (included below), contact the Florida Department of Revenue at (850) 488-6800.

12. I heard there were several sales tax holidays this year. Where can I find more information about the other holidays?House Bill 7071 from the 2022 regular legislative session was signed into law on May 6, 2022. The new law contains ten tax relief holidays and specifies the timeframe for each holiday.

For a printable calendar of the tax relief holidays, you can visit our website: Florida Dept. of Revenue – Sales Tax Holidays and Exemption Periods (FloridaRevenue.com).

Here is TIP No. 22A01-07:

-

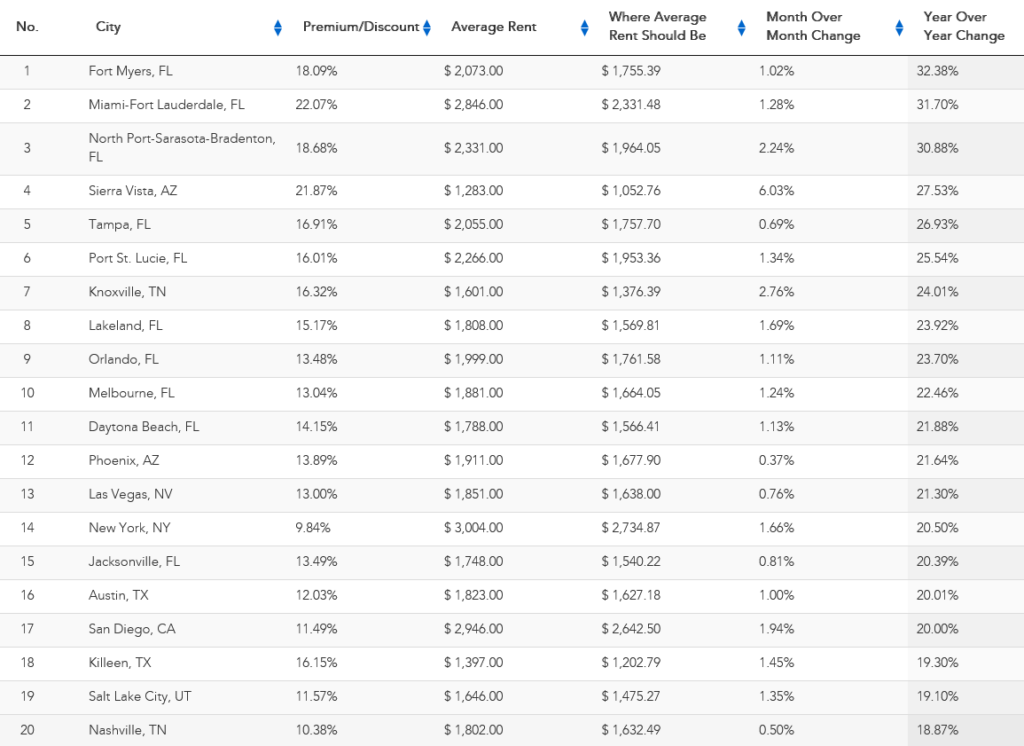

Florida Rent Keeps Rising

According to FAU’s Waller, Weeks, and Johnson Rental Index, rental rates across the country have continued to increase at a rapid pace. In year-over-year percentages, double-digit rent increases occurred in 92 of the 107 Metro Areas that they measure across the United States.

Here’s a Screenshot of the Top 20 Metros Sorted by Rental Percentage Increase:

Top 20 Metro Areas Sorted by Percentage of Year Over Year Rent Increase Florida Tops Rent Rate Increases

10 of the top 20 metro areas with the largest rent increases are located in Florida, with Jacksonville taking the #15 spot at a 13.49% increase in rental rates for April 2021 to April 2022 and almost a 1% increase over the last month alone (0.81%).

According to their research, average current rents for Jacksonville are $1,748 per month where they were expected to be around $1,540 based on previous historical price trends. This means that Jacksonville area rents are 13.49% higher than they ‘should be’, or what they are referring to as ‘overvalued’.

Rents are determined primarily by supply and demand, so ‘overvalued’ is a relative term. Until and unless vacancy rates start increasing to the point where landlords begin to offer lower rates or incentives, rental rates are likely to keep rising. More new apartment communities being built will provide more inventory, which will help along the way, but as we’ve seen in other recent articles, there is a Net Positive Migration from other states into Florida thus keeping demand high.

Another trend taking place, especially in touristy areas like downtowns and beaches, is long-term rental units being purchased and/or converted to short-term rentals using AirBnB and the like. Landlords are realizing increasing gains with short-term rentals since they can charge more on a per-night or weekly basis than they can on a monthly or annual basis.

We’re even seeing trends where gutsy entrepreneurs are snapping up annual rentals and sub-leasing them as short-term rentals. Of course, there are pitfalls to this strategy including ensuring that primary lease agreements legally allow sub-leasing as well as potential local zoning issues.

For the moment, rents across the country are increasing and since real estate is all about Location-Location-Location, it makes sense that rents in Florida continue to increase.

As we continue to say…

If you’re paying for housing, you’re paying SOMEONE’s mortgage.

You’re either paying Your Own Mortgage, or you’re paying your Landlord’s.

That choice is yours.If you’re looking to buy or rent, Aqualand can help. Contact Us Today for a Free Consultation.

-

4 Tips to Prepare to Sell Your House

Getting a house ready to sell can pay off big if the right things are done to really show off the home and add curb appeal.

Here’s a look at 4 tips for making sure your house is ready for those top-dollar bids!

Considering Selling?

Reach Out Via Email or Phone,

and We’ll Run the Numbers for You!4 Tips for Spring Cleaning and Preparing to Sell Your House

To prepare to sell your house for the market, remember to use these tips!

- Paint the Exterior and Front Door

Neutral colors can help attract buyers and boost your sales price! - Deep Clean

Clear out the rain gutters, sweep dirt and leaves from pathways, and clean shutters and windows. - Plant Some Colorful Flowers

Plants are an easy way to add some color without spending much, and bright flowers will add curb appeal! - Spruce Up the Landscaping

Make sure the lawn is mowed, leaves are raked, and fresh mulch is spread so that landscaping looks its best for showings.

Considering Selling?

Reach Out Via Email or Phone,

and We’ll Run the Numbers for You!We’ve got lots more tips to prepare to sell your house or condo. We provide home prep guidance and for all of our Sellers.

- Paint the Exterior and Front Door