Real Estate Market Update July 2022

Where are we in the current real estate cycle? Will a recession kill the housing market?

We are more than halfway through 2022, so it seems like a good time to provide a general update on the state of the real estate market across the country and here in Florida. The National Association of Realtors’ Chief Economist put out this statement concerning his opinion of the housing market via LinkedIn on July 19, 2022:

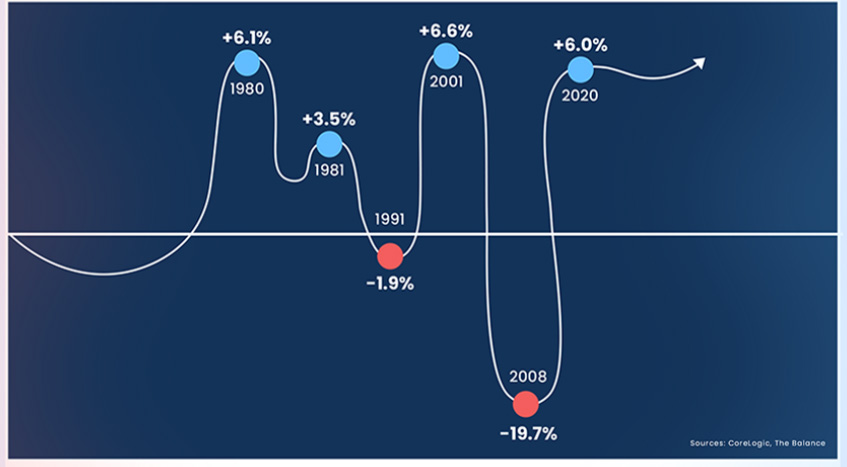

In my humble opinion as a Florida Real Estate Broker since 2004 and now located and selling homes and land in Saint Augustine and Saint Johns County, we’re in the second half of the 18.6-year real estate cycle, which should continue into 2026. While ‘housing supply challenges [may] continue into the coming months and into next year‘, the overall trend is an increase in property values. Even looking at recessions over the last 40 years, real estate prices increased in 4 of 6 of those recessions, including when mortgage rates were significantly higher than they are now.

The Real Estate Cycle and Ever-Taller Buildings

As is oft the case, the real estate cycle is likely to peak right around the time that all that exciting multi-family comes online, primarily in the form of new and higher high-rises and the world’s tallest buildings. Take a peek at the expected completion date of many of the newest tallest buildings… 2026. If history repeats, the South Florida real estate market will start showing cracks before the rest of Florida, and possibly the rest of the country.

Aqualand was located in Fort Lauderdale during the last downturn, and signs of the top started showing up right after Hurricane Katrina. With Hurricane Wilma’s arrival a few short months later, the market had already started to turn hard. By Spring of 2006, selling was tough and many folks had started to sell at a loss or consider allowing the bank to take the property back without a fight. Many of the new high rises in Miami were completing in late 2005 and early 2006. By 2008 and 2009, the vacancy rate in downtown Miami’s newest and tallest was beyond significant. The bottom didn’t come until late 2011/early 2012.

Upward Trend in Renting

Many folks are listening to the doom and gloom news and expecting a housing crash too soon in this cycle. The talking heads and pundits want to play Michael J. Burry in ‘The Big Short’ and pat themselves on the back for being the first to ‘call the top’ this time around. They’ll likely keep repeating their warnings until they finally give up and join the herd – probably just in time for the actual crash. We expect that as the 12-month leases that have been signed in the first half of this year start to expire, many of those folks will FOMO into the housing market again… at higher prices than today.

Buyers who have been cancelling their new construction contracts because of higher interest rates will kick themselves for walking away from earnest money deposits or worse, paying hefty cancellation fees and penalties. Those who are sued for specific performance and forced to close will likely breathe a sigh of relief once their equity becomes apparent. Others will lament not jumping in sooner and will resolve themselves to renting longer-term. Many will complain the housing market is unfair since they can no longer afford their ideal dream home with all the bells and whistles.

Most buyers would be far better off buying something inline with their actual housing needs and financial situation rather than falling victim to unrealistic expectations set by trendy design magazines and the exaggerated posts of ‘influencers’. Keeping up with the Joneses who buy now will be tougher a year from now.

“Markets can stay irrational longer than you can stay solvent.”

John Maynard Keynes, Economist in the 1930s

Sticking Pension Funds and Retail Investors with the Bill… Again

Many investors (hedge funds included) are buying and/or building single family homes and leasing them in an effort to store value and offset holding costs while they wait for the peak. This may eventually create enough competition for renters to upgrade their rental or locale without breaking the bank, but we’re not there yet. We wouldn’t be at all surprised if some of the major builders raise capital or create subsidiaries to hold onto some of their newly completed homes (or entire new neighborhoods) as rentals to capitalize on current and near-term appreciation.

Many of those funds and perhaps some builders eventually will start to sell their inventories to pension funds, REITs (Real Estate Investment Trusts), and ETFs (Exchange Traded Funds) in $100 million blocks as performing asset portfolios to raise additional purchasing/building capital and take some significant profits off the table. Some smarter funds and investors will likely start divesting in early to mid-2025 and getting more aggressive as we move closer to 2026. Once again, pension funds and retail investors will be left holding the bag, just as they were holding over-hyped MBS assets (Mortgage Backed Securities) in 2008 only to sell them at a net loss.

So, does it make sense to wait for rates to come down or wait for a downturn to buy a house? Nope.

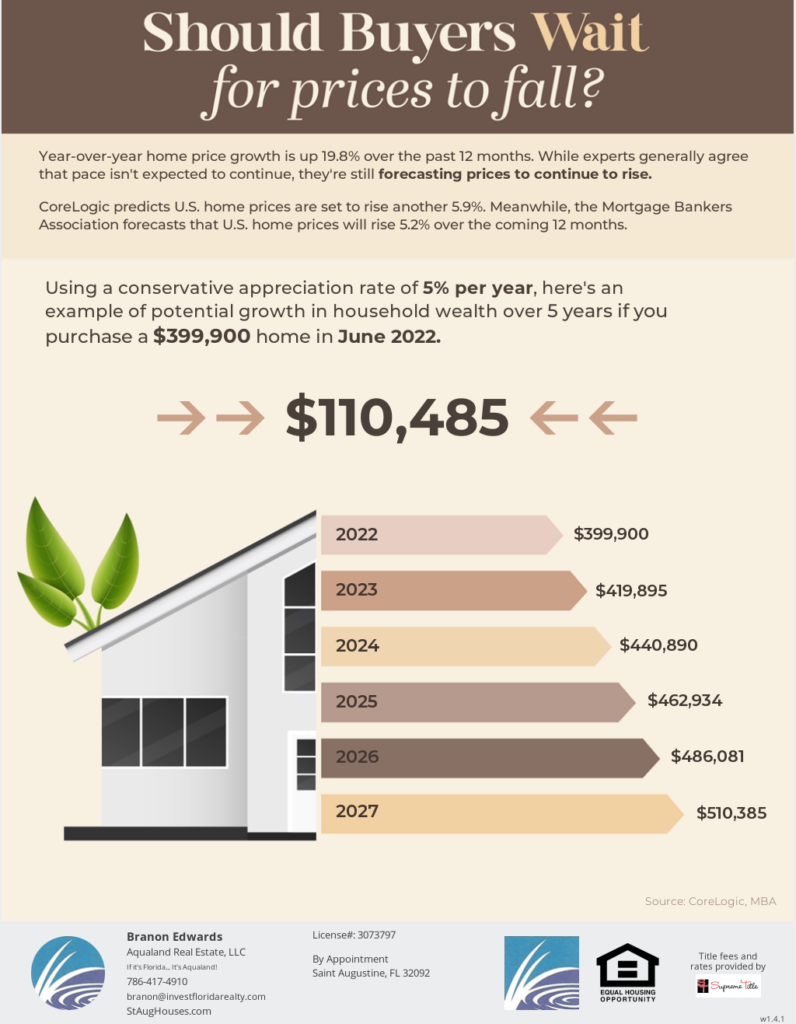

Again, in my humble opinion, No. While we may not see 19.8% appreciation in 2022 or 2023 as we did in 2021, we are likely to see at least a conservative 5% appreciation. Personally, I see us appreciating faster than interest rates, which should eventually level off once the Fed is done overreacting to having been behind the curve in the first place (as per usual). Again, if history repeats, the last couple years of the real estate cycle will involve significant appreciation, well above 5%.

Here’s a real estate infographic to explain what 5% appreciation looks like for a $399,900 property over the next few years:

If mortgage rates drop, you can always refinance and take advantage of the lower rates. However, you cannot recapture lost appreciation, especially if your monthly housing expenses are being paid to a landlord and not toward your mortgage and home equity.

If you’re paying for housing,

you’re either paying your own mortgage

or your landlord’s mortgage.

If you’re in Florida, we always recommend Charles King at Grass Roots Mortgage for purchases and refinancing. He’s been our go-to Florida mortgage broker since 2010 and can help with Conventional, FHA, VA, and Investor Loans.

If you take advantage of low down payment financing with FHA (just 3.5% down), remember that you will have to refinance your way out of PMI (Private Mortgage Insurance). Getting an FHA loan now and refinancing out of it once appreciation takes you above the 20% equity threshold is a reasonable plan if you’re not sitting on a substantial down payment.

Conventional mortgages typically require 5% down, but you can ask the lender for to re-appraise your home to confirm your mortgage balance is 80% or less than the current value. You’ll pay for the appraisal, but it is well worth dropping the PMI, which could be hundreds per month. With decent appreciation, your equity grows faster than you might think.

With conventional, you don’t have to refinance out of PMI – they simply cancel the PMI once 20% equity is achieved – either via appreciation or having paid down your mortgage, but ONLY IF YOU REQUEST IT. If you do nothing, the lender should automatically terminate PMI once you pay the mortgage down to 75% LTV, but you will have wasted months (if not years) of monthly PMI payments for lack of being proactive.

If you have questions, please Contact Us

for more information about your specific situation.

State of the Market for Saint Augustine’s 32092 Area

Saint Augustine/Saint Johns MLS as of 7/23/22 for 32092

| Active Residential Listings: | 128 |

| Pending/Contingent Residential Listings | 146 |

| Residential Sold Year-to-Date | 281 |

| Average Days on Market Year-to-Date | 31 |

| Median List Price | $415,000 |

| Median Sales Price | $413,610 (-0.335%) |

| Active Vacant Land Listings | 14 |

| Pending Vacant Land Listings | 5 |

| Vacant Land Sold Year-to-Date | 11 |

| Residential for Rent | 6 |

| Residential Rented Year-to-Date | 1,063 |

Jackonville’s NEFAR MLS as of 7/23/22 for 32092 Real Estate

| Active Residential Listings: | 272 |

| Pending/Contingent Residential Listings | 355 |

| Residential Sold Year-to-Date | 858 |

| Average Days on Market Year-to-Date | 30 |

| Median List Price | $460,000 |

| Median Sales Price | $461,997 (+0.434%) |

| Active Vacant Land Listings | 33 |

| Pending Vacant Land Listings | 9 |

| Vacant Land Sold Year-to-Date | 21 |

| Residential for Rent | 34 |

| Residential Rented Year-to-Date | 161 |

Summary of MLS Data

Based on the above information for our two local Multiple Listing Services, the market is still brisk. A typical, healthy market has an average days on market of 3-4 months and as much as 4-6 months. At right at a month year-to-date, we’re still selling properties faster than what is considered typical. The difference between the Listing Price and the actual Selling Price is negligible with Saint Augustine’s MLS at a small discount and Jacksonville’s MLS at a slight premium.

We show data from both MLSes because Aqualand is a member of both area MLS systems. Saint Augustine is traditionally a smaller local market, but in today’s marketing environment, we believe it makes sense to advertise our listings to the largest possible audience. With many Saint Augustine realtors only belonging to the St Augustine and Saint Johns board and many Jacksonville real estate agents only belonging to NEFAR, it makes sense to us to give agents from both areas an opportunity to find our listings. Further, it gives us a broader pool of potential homes and properties for our buyers as well. We set up listing portals in both MLSes for our Buyers so they have the most up-to-date information whenever they want it – 24/7 where they can even create their own searches and expand or contract their options at will. If it’s out there, we’ll help you find it.

Location Location Location

Remember that location is still the most important consideration when choosing a property. Saint Johns County has great weather complete with a change of seasons, has one of the better rated school systems in Florida, it is conveniently located with plenty of amenities and activities (beaches, rivers, shopping, restaurants, night life, and cultural events) as well as health systems and abundant employment opportunities.

Saint Augustine’s 32092 zip code is located in Saint Johns County just West of I-95 and just South of I-295, but within an easy commute to Jacksonville, historic St Augustine, the Saint Johns River, and the beaches. There is plenty of shopping at Murabella, World Golf Village, and Durbin Crossing with new strip centers coming online later this year and next. A new Costco opens in August near the new Buc-ee’s at WGV and 95.

Silver Leaf is a large planned community that offers a variety of housing opportunities including single family homes, townhouses, and even luxury apartments. The community features a number of different national and regional builders. There are plenty of established neighborhoods as well including Murabella and Arbor Mill, which has a large lake, ponds, and an amenity center.

If you would like a Free Buyer or Seller Consultation, please Contact Us.

Summary

In our opinion, we are in the second half of the 18.6-year real estate cycle, the market still has significant upside, and should continue upward into 2026. We think it is a good time to buy despite interest rates since appreciation cannot be recaptured once it is missed, and many Buyers will end up suffering from FOMO (fear of missing out) and buy in at even higher prices later.

We believe Buyers should give serious consideration to what they really need versus their wish list in a ‘perfect’ house, townhouse, or condominium. The ultimate goal should be to stop wasting money on rent (your landlord’s equity) and to start building equity for yourself instead or to move to an area where you really want to live.

Please note that if you are leaving a high-tax/high-regulation state and coming here to no-income-tax, business-friendly Florida, please remember why you’re leaving that other place, and try not to bring that nonsense with you. We like our Florida and don’t care how you did it somewhere else. As lovely as that other place may be, you’re leaving it for a good reason likely other than just sunshine, palm trees, and oranges. Just sayin’.

As interest rates stabilize, Buyers can refinance later to take advantage of any mortgage interest rate drops, to eliminate PMI costs, and/or to tap equity to pay for improvements or pay down higher interest debt like credit cards and car payments. It is advisable, however, to minimize debts and payments heading into 2026 and the subsequent 4-year downturn similar to 2008-2011. Remember, the real estate cycle is not only 14 years up, but also 4 years down.

We also believe Sellers should price their properties realistically. We are not seeing the bidding wars we did last year, and overpricing a property in this environment can lead to stagnation and disappointment as some Buyers and Agents see a longer days-on-market as a hint that something may be wrong with the property, not just its price. Aqualand’s higher end Seller Services option also includes a formal appraisal, which allows us to take advantage of additional selling and marketing strategies to maximize value despite expenses.

Sellers should also consider being creative with sale terms. Rather than taking a public price reduction, consider offering to help the Buyer buy down their interest rate. Here’s our Facebook Post on the Seller Buy Down Strategy. Aqualand will walk with you every step of the way in your home selling journey and provide advice and guidance specific to your situation, goals, and deadlines.

Investors should consider rotating out of properties in lower-appreciating areas or properties that may need more maintenance over the next 5 years and into better locales that will sustain solid cashflow after the market tops out in 2026. Utilizing the tax benefits of a 1031 Tax Deferred Exchange wherever possible is typically advisable, but every situation and every investor is different and deserves individual attention.

Investors should endeavor also to be in a cash-heavy position going into 2029-2030 as the 4-year downturn starts to bottom out and banks liquidate their REO inventory and short sales are in full swing. Opportunities will come along before, during, and after those periods, so keep yourself open and in a position to take advantage of opportunities as they present themselves.

Across the board, Americans should be very careful with their financial institutions as this real estate cycle will bring with it a banking crisis just as those previous. It is our opinion that the ‘too big to fail’ banks may actually fail this time around. Instead of 2008-like Bail-Outs, banks are likely to execute Bail-Ins similar to what was seen in Cyprus during the last downturn. Essentially, depositors may find themselves seeing their funds become assets of the bank and receiving bank shares instead. While it may be exciting to own part of a bank, you cannot buy groceries with bank stock.

Avi Gilburt at Elliott Wave Trader recently opened a Safer Banking Research Service that focuses on researching the strength of various banks and will be making recommendations as to which banks are most likely to withstand the widespread bankruptcies we’re expecting in 2028.

Similarly, investors should monitor their stock portfolios and adjust accordingly as the cycle continues. We anticipate the stock market to top out about a year ahead of real estate with the S&P likely around the $5,500 range, possibly $6,000 followed by a significant and longer-term bear market in equities. Between a bear market and a potential real estate-related downturn, pension funds, IRAs, and 401Ks could be significantly impacted right when many folks will need them most. As with all things, do your own due diligence and research.

Please Note: Aqualand is not a licensed financial services provider, CPA, or attorney, and as such, this article is not financial, tax, or legal advice, just our opinion of how we see the overall cycle based on our own research and experience. Please consult your licensed financial advisor, tax advisor, and legal counsel before making decisions related to your finances especially as they relate to income tax, capital gains, and legal structures. Your home is likely one of your largest investments and expenditures and should be treated with care and diligence.

If you would like a Free Buyer or Seller Consultation, please Contact Us.

As always, thank you for the opportunity to earn your business.